But I was too busy, so it is happening mid-June.

Which sectors did I favor this time?

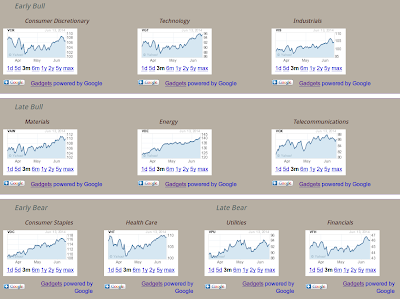

The graphs show that Energy and Consumer Staples have been doing the best during the past three months. Since part of sector investment theory is that "chasing gains" is possible with sectors, since they wiggle less erratically than stocks, then those two are good picks. (I just need to do better about monitoring my picks more frequently than every six months!)

There is also the Forward P/E difference tool.

Forward P/E Difference = ( Forward P/E − 15-year Avg. P/E ) ÷ 15-year Avg. P/E

It also likes the Energy and Consumer Staples sectors. And it suggests Materials and especially Utilities are two other good picks. But the Forward P/E difference is less reliable guidance, so I weight those less so far as how much to invest in them.

Since I am not comfortable investing in only four sectors, I also added Industrials, which has the next-best Forward P/E difference of the sectors that have been doing okay lately. I weight it least.

The Fidelity ETFs I use have no cost to buy or sell as long as I hold them at least one month. I only had two sectors that were good picks from both recent behavior and the Forward P/E difference. So I should check in again a month and see how these choices are doing, and meanwhile try to do better about reading some financial news about the sectors.

UPDATE: If you read my web page about sector investing, you can see it describes seven tools to analyze the current status of the sectors. I only used five, and only blogged about two. Too busy to be more informative. Sorry!

No comments:

Post a Comment