I'm trying to learn more about economics, to better understand the interesting news of the past two weeks.

Tonight I was reading about corporate leverage. To summarize: borrowing to consume is a bad economic strategy, but it can be wise to borrow to pay for increased profit potential (better farm equipment, building another factory, etc.). Mathematically, leverage is the ratio of a company's operating income to net income. The issue relevant to recent news is that leverage attempts to increase profit by increasing risk.

Households borrow also--usually to consume, but sometimes for leverage.

So, how healthy is the economy in regards to debt and leverage?

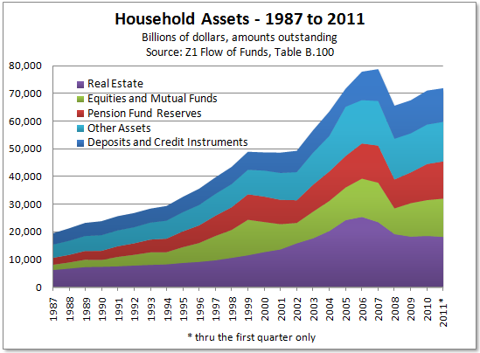

As a preface, here is a chart about total U.S. household asset value:

What does this chart mean? It depends upon how real you believe the value is.

If you think that value is now more-or-less accurate then this chart is good news. Households are acquiring more despite the recession.

On the other hand, if you think that either home prices (purple) or the market (green and red) are over-inflated then this chart is bad news. People might think they own a bit more than they did in 2008, but they really don't.

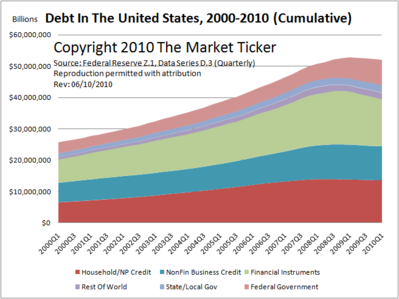

Now to answer the main question. Here is a similar chart (but different years) about U.S. debt.

The green band shows that financial institutions are de-leveraging. That is a trend I have not read about before. Banks are reducing risk even if it reduces profit. That seems like good news.

The red band has become a stable width: households are not changing their amount of debt. We can combine this with the first chart that shows household asset growth and it also seems like good news. Households are borrowing a smaller amount compared to their valued assets. Whether or not the value is real, Americans are trying to borrow less.

The blue band shows that other companies also have a stable amount of debt. How is their leverage? Corporate incomes are slightly up, so companies are leveraging as usual. I expect that is good news too. We want companies to grow with more equipment and factories and stuff.

However, a complication arises because corporate asset values are dropping (the real estate and equipment owned by companies are worth less because of lower real estate prices, lower demand for reselling it, and inflation). The leverage ratio is not changed since it compares operating and net income. But the amount of risk created by the same amount of leverage increases since a larger portion of assets is gained through borrowed money. (The company still has a nice new factory built by borrowing $x, but now the other, older, paid-off factory is worth $x/2 instead of also being worth $x.)

So we reach three conclusions by looking at debt and leverage. Banks are shedding risk. Households are trying to reduce debt. Companies are trying to use leverage to grow despite facing more risk from using leverage.

Did I get this right? I'd appreciate if anyone with more economic expertise offered correction or confirmation.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment